As live auctions resumed at Sotheby’s on Wednesday night, bidders there and at Christie’s the previous night welcomed a shift toward diversity in the contemporary art market.

Just as the art market withstood the trauma of the Sept. 11 attacks and the economic plunge of 2008, so did the purchasing of high-priced paintings prevail at Sotheby’s on Wednesday during the first live contemporary auction since the onset of the pandemic in March 2020. Somehow, whatever crises convulse the world, the wealthy continue to buy art.

In a deliberately sparse salesroom in Manhattan, with auction specialists beamed in from London and Hong Kong on screens, business was strong at Sotheby’s, which raised a total of $218.3 million from 32 lots. Christie’s raised $210.5 million on Tuesday evening from 37 lots in a fully virtual sale.

Oliver Barker, a Sotheby’s auctioneer, seemed palpably energized by the return to a live sale and the new format, at one point pronouncing the market “back in fine form.”

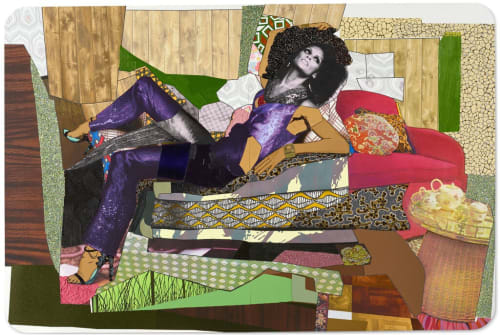

The only clues that the world had changed over the past year was that the focus seemed to have shifted from the usual blue-chip art market darlings to artists of color, several of whom — Jordan Casteel, Mickalene Thomas and Rashid Johnson — set high prices for their works at auction.

Among the lots that generated particular bidding excitement was Robert Colescott’s take on Washington crossing the Delaware, placing George Washington Carver in command. It was purchased for $15.32 million, with fees, by the Lucas Museum of Narrative Art in Los Angeles, whose opening has been delayed until 2023.

“This is such an essential work for our collection — it has not been out there in the public sphere,” Sandra Jackson-Dumont, the director and chief executive of the museum, said in a telephone interview after the sale. “This work is a significant part of the history of artists doing narrative work. It’s at once contemporary and historical.”

Also noteworthy was the competitive bidding for Salman Toor’s 2019 painting “The Arrival,” which was recently on view in the artist’s solo exhibition at the Whitney Museum of American Art. It sold for $867,000, more than 10 times its estimate.

Other lots proved lackluster, like Jeff Koons’s phantasmagoric painting “Pancakes,” from 2001, which sold for $867,000 with fees, under the $1 million low estimate. However, his kaleidoscopic “Quad Elvis,” from 2008, in the same sale, sold for $9.5 million, exceeding the $6 million high estimate.

The anticipation was highest for the market’s blockbuster Black artist, Jean-Michel Basquiat, who had delivered at Christie’s with a skull painting that brought $93.1 million — the second-highest price ever paid for the artist’s work at auction. But expectations for Basquiat fell short at Sotheby’s when the artist’s “Versus Medici” sold for $50.8 million, squeaking over the high estimate rather than going well beyond it.

To some extent, Wednesday’s sale represented a test of the hybrid auction experience, with a new salesroom created by the Broadway set designer David Korins and about 50 New York residents as a champagne-sipping live studio audience, though most attendees tuned in via livestream.

“It’s like the NBC studio in there,” said Betsy Orchard, an art collector who was present. “It feels safe here, and there’s a lot of momentum in the air for bidding.”

But from their blue velvet lounge chairs, only a few collectors raised their paddles to bid. The majority of the action happened over telephones and internet portals, signaling that the digitization of the art market could continue beyond this moment of global crisis.

But from their blue velvet lounge chairs, only a few collectors raised their paddles to bid. The majority of the action happened over telephones and internet portals, signaling that the digitization of the art market could continue beyond this moment of global crisis.

In addition, Banksy’s “Love Is in the Air” sold for $12.9 million over a high estimate of $5 million, the first work at auction for which Sotheby’s accepted cryptocurrency.

By contrast, the energy seemed to drain from the rooms when it came to the more conventional contemporary market stars. At Christie’s, for example, paintings by Gerhard Richter, Christopher Wool and Richard Prince sold to their backers without any competition.

Strong bidding from collectors across the globe also helped reinforce the idea that auction houses’ embracing of online sales, which started during the pandemic, might finally be paying off after a year in which global auction sales declined 26 percent.

Still, some industry experts warned that the auction houses were hedging their bets this week with relatively few offerings compared with years past, estimates below primary-market prices and a high proportion of guarantees ensuring that lots would sell. More than 40 percent of lots in Tuesday’s sale at Christie’s had such assurances.

“The guarantees are not great for the auction houses’ margins,” said Natasha Degen, chairwoman of art market studies at the Fashion Institute of Technology. “And the relatively small number of lots will also limit the sales’ profitability.”

Still unclear is whether the current interest in artists of color will last. But for two nights this week, it felt as if a new world was in the offing, one in which work by a Ghanaian painter like Amoako Boafo could sell for twice the high estimate — and a longtime auctioneer would have to beg the crowd to “keep those eyes awake” as they bid on Marc Chagall.